July 2011

Demonstrators march on Syntagma (Constitution) Square Greek parliament in Athens, June 15.

(Photo: Agence France-Presse)

A new wave of mass struggle has broken out in Europe in response to the drive by the capitalist rulers to saddle the workers with the costs of the global economic crisis, already in its third year. Following the Wall Street panic of September 2008, imperialist governments poured in trillions of dollars to shore up tottering banks. Despite “stimulus” measures, mass layoffs spread. Tens of millions of workers in the industrial countries lost their jobs. The actual unemployment rates are often double the reported figures (over 16% of the workforce in the United States rather than the official 9%). Within a year, the banks were once again raking in huge profits, but someone had to pay the costs of the bailout. So last year, in one country after another, under governments of the “left” and right, capital used the crisis to launch a full-scale assault on labor, particularly going after public sector unions to dismantle pension plans, lower wages, slash employment and rip up workers’ rights. Labor protests broke out in Greece, Spain, France, Portugal, Britain and elsewhere (see “Focal Point Europe: Capitalism in Crisis, Class Struggle Erupts” and other articles in The Internationalist No. 32, January-February 2011).

The anti-labor offensive has continued, touching off revolts in unexpected places, including the Midwestern U.S. state of Wisconsin. Last year, the bosses won the first round. In Greece, the initial flashpoint, this defeat was embodied in the Memorandum signed by the Greek government with the “troika” of the International Monetary Fund (IMF), European Central Bank (ECB) and European Union (EU). Slashing public workers’ wages by 30 percent in order to lower the budget deficit was supposed to enable the government to pay off debt. Instead, such austerity measures sank the economy deeper into depression. Now, barely a year later, the banks and governments are demanding more cuts, privatizations and layoffs, alleging that if Greece defaults it will likely lead to a chain reaction in Portugal and Spain and an international financial crisis that could sink the euro and shake the world economy. However, now not only the unionized working class but hard-hit middle-class sectors are up in arms saying, “We didn’t cause the crisis. We won’t pay for it.” Even so, the hard fact is that as long as capital rules, it is the mass of workers, poor and intermediate layers who pay to enrich the tiny layer of exploiters.

Police face off

with demonstrators during

June 15 general strike. (Photo: Agence

France-Presse)

Police face off

with demonstrators during

June 15 general strike. (Photo: Agence

France-Presse)

2011 began with uprisings sparked by unemployed youth in Tunisia, Egypt and elsewhere in North Africa and the Near East – accompanied by a murderous imperialist war on Libya in the guise of “saving civilian lives.” Then came the labor revolt in Wisconsin. By the second quarter protests against brutal austerity were again breaking out in Europe. Beginning in Spain in May and spreading to Greece, along with mass marches of hundreds of thousands, mass assemblies have sprung up, camping out in central city squares. Drawing inspiration from the occupation of Tahrir (Liberation) Square in Cairo, these assemblies of “indignados” or “aganaktismeni” (the outraged) have attracted many previously quiescent layers of the population. These are not ritual parades by reformist trade unions or the no less ritual clashes with the police by anarchist or semi-anarchist youth. Sparked by university-educated youth consigned to temporary contract jobs, or unable to find work at all, the mass meetings have also drawn in middle-class sectors facing ruin due to the severity of the economic crisis. This presents important opportunities for the struggle against the capitalist offensive, but also real dangers as reactionary forces intervene.

Most of the left effusively hailed the indignados’ calls for “real democracy.” For one thing, they parallel the policies of the reformists who have abandoned any pretense of fighting for socialism and instead put forward a purely (bourgeois) democratic program. But such amorphous “movements” accept the capitalist framework – instead directing their ire at corrupt politicians and thieving “banksters” – and could even become a recruiting ground for dangerous rightist and nationalist-populist currents. This has already begun to happen. From Madrid to Athens, assemblies have banned parties, unions and symbols. No communist red, anarchist black or syndicalist red/black flags allowed – but in Greece, national flags abound. “Far left” militants intervening in the squares hide their party affiliations, while in their publications they soft-peddle the bans as due to the history of betrayals by reformist union and party bureaucrats. The effects of the sellouts are real, but in many cases this is crude anti-communist and anti-labor sentiment fed by the bourgeois media and politicians. Rather than acquiescing to these bans, Trotskyists forthrightly explain the need for a revolutionary party and class-struggle trade unionism.

These new petty-bourgeois layers made their first appearance in Portugal on March 12 with mass marches in Lisbon, Porto and other cities numbering up to half a million participants. It was the largest mobilization since the aborted “Revolution of the Carnations” of 1974-75. A group of youth calling themselves the geração à rasca (which they translate as “precarious generation”) organized the protest via a Facebook page on the Internet, following the example of the January 25 “day of rage” in Egypt. Signs proclaimed “No Country for Young People” (a takeoff on the Cohen brothers film No Country for Old Men), although they could have said old and young, as pensions are being slashed while youth are at best consigned to temp work. Other signs spoke of a “temp revolution” (revolução precária). The marchers denounced the Socialist Party government of José Sócrates, which tried to ram legislation through the Portuguese parliament embodying the IMF austerity demands in return for a €78 billion (US$113 billion) IMF/ECB bailout, agreed to in May. The official trade union federations (Communist-led CGTP and Socialist-led UGT) had done nothing following a successful November 2010 general strike.

Next came the May 15 protest which brought out tens of thousands in more than 40 Spanish cities. Demonstrators in Madrid protested against police attacks by occupying and then camping out in the Puerta del Sol. This was quickly followed by camps (acampadas) in Barcelona’s Plaça Catalunya, in Valencia and elsewhere that continued to occupy the plazas for the next month. The demonstrations were called by a newly minted group, Democracia Real Ya (DRY, Real Democracy Now) under the motto, “We are not a commodity of the bankers and politicians.” While saying “some of us are more progressive, some are more conservative,” the DRY platform proclaimed “we are all upset and outraged [indignados] at the social, political and economic panorama” under the Socialist (PSOE) government of José Luis Zapatero. Resisting orders to clear the plazas before May 22 local elections and subsequent police attempts to evict them, the indignados held out for weeks. On June 15, several thousand surrounded the Catalan parliament, trying to block a vote on an omnibus austerity law, and on June 19 up to 750,000 marched in 90 cities against the anti-labor “competitiveness pact” adopted by eurozone countries in March.

Following Spain came Greece, where on May 25 an occupation began in Syntagma (Constitution) Square in front of the parliament building in Athens. Some 150,000 people demonstrated in all major cities against the austerity policies of the Panhellenic Socialist Party (PASOK) government of George Papandreou and the diktat of the EU/ECB/IMF “Troika.” It is notable that in all three countries, the protests are against “socialist” governments of the parliamentary “left” (despite its name, the PASOK is actually a bourgeois nationalist party). Since the international bankers have trained their sights on Greece as the first target of their “austerity” drive, the scope of protests and intensity of the protesters’ anger have been far greater, producing an explosive situation. On June 5, 100,000 gathered in Syntagma Square, followed by several days of rolling strikes in state-owned companies, a one-day general strike on June 15, and a two-day general strike – the first since the overthrow of the military junta in 1974 – on June 28-29 as parliament voted the austerity/privatization package.

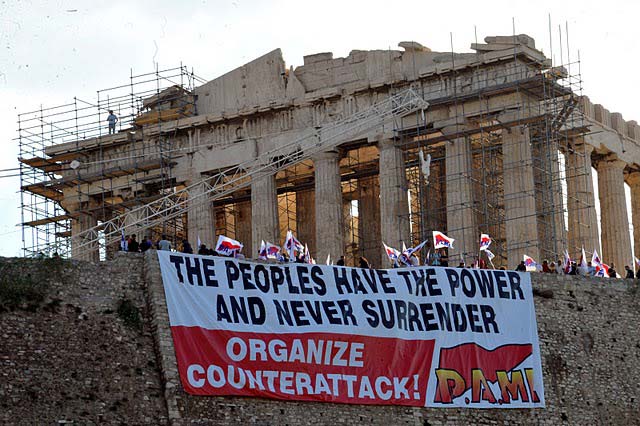

Banner

of

the Communist-led PAME trade-union

federation at the Acropolis in

Athens, June 27, on eve

of two-day general strike. (Photo: KKE)

Reference to the brutal colonels’ regime is not hyperbole. Today, Greece is being subjected to debt peonage on a mammoth scale under a dictatorship of finance capital, decreed by a junta of international bankers and enforced by the iron discipline of “the market.” The latter turns out to be the (U.S.-owned) credit ratings agencies and a coterie of banks determined to boost their profits by sticking it to working people. Even some bourgeois economists have commented that it may take another junta to implement the austerity program demanded for “rescuing Greece” (in reality bailing out the banks). The Greek government has threatened just that: in an interview with the Spanish daily El Mundo (26 June), Deputy Prime Minister Theodoros Pangalos said that if parliament refused to vote the package of laws accompanying the new bailout, “The next day, people would besiege the banks trying to withdraw their money, the army would have to protect them with tanks, as the police would not be enough, there would be revolts everywhere….” This is no idle observation: a few days earlier, Papandreou named as new finance minister the defense chief Evangelos Venizelos (who knows little of finance but is on good terms with the military).

After all the Sturm und Drang (storm and stress) of the protests and parliamentary drama in Athens, PASOK deputies narrowly approved the austerity bill. Zapatero and the PSOE are still carrying out the bankers’ orders in Madrid, despite heavy losses in local elections. And although Portuguese prime minister Sócrates and his PSP were turned out in June, it was the right wing Social Democrats who benefited from the discontent, while the Popular Party in Spain (heirs of the Franco dictatorship) made advances and in Greece the conservative New Democracy is ahead in the polls based on its opportunistic opposition to the austerity package. Despite hundreds of thousands in the streets and thousands camped out in central squares, capital is winning round two against labor as well. With the parliamentary “left” implementing the capitalists’ program, the “extra-parliamentary” left calls for limp trade-union tactics (marches, symbolic “general strikes”) that are doomed to failure, while default and exit from the euro would hit workers with runaway inflation and even more massive unemployment. The only real answer to the capitalist crisis is Europe-wide socialist revolution.

Greek Default and Euro Crisis

The reason that the euro-bankers and “bond vigilantes” are on the warpath again barely a year after the €110-billion IMF/ECB/EU “bailout” of Greece is the sharp economic downturn exposing the fictional character of the original plan. It’s not only Greece . For months, Western governments and their international financial agencies were prating about a “recovery,” although unemployment is as high as ever. The reality is that the advanced capitalist industrial countries are stuck in a full-scale depression that will take years to overcome, through massive destruction of capital (shutting down factories, escalating mass unemployment), imperialist trade war or actual shooting war. There’s no surprise, really: plenty of “mainstream” economists predicted that the first Greek “bailout” wouldn’t work. Piling more new debt on top of old while slashing wages and jobs only made the situation worse, so today the accumulated international public debt of Greece went from 113% to almost 150% of the gross domestic product and rising.

The bourgeois press and media are full of stories about profligate Greeks, public workers who laze about for years and then collect exorbitant pensions. This is nothing but capitalist propaganda blaming the victims of the crisis in order to exonerate (and fatten the profits) of the looters who set it off.[1] In Greece, workers have taxes deducted from their paychecks (in addition to paying a “value added” tax, now up to a whopping 27%, at the cash register), while the bourgeoisie treats tax evasion as a national sport. The owners of the Greek shipping fleet, the largest in the world (although largely sailing under flags of convenience like Panama or Liberia), pay only 15% on their declared profits, while most earnings are siphoned off to tax havens like the Cayman Islands. When the government announced it was going to increase property tax collection by using Google Earth satellite photos to go after the huge number of undeclared swimming pools in the opulent Athens suburbs, owners rushed out to buy astroturf and asphalt to cover up their assets (Michael Hudson, “A World at Financial War,” Counterpunch, 6 June).

In any case, none of the tens of billions of euros now supposedly being deployed to “rescue Greece” will ever find their way to Greek pockets. Even Greek banks, which hold a majority of the debt, will be stiffed. Instead every euro will be electronically transferred to banks in Frankfurt, Paris and elsewhere in Europe just to pay the usurious interest on the bonds and notes. Of course, the point was never for Greece to pay off the loans, but to impose financial “discipline” by extracting huge sums through taxes to “service” the mountain of accumulated debt. Indeed, the national debt is such a marvelous means of amassing capital that Marx ranked it right up with slavery and the colonial system as one of the key engines of modern capitalism:

“The system of public credit, i.e., of national debts, whose origin we discover in Genoa and Venice as early as the Middle Ages, took possession of Europe generally during the manufacturing period…. National debts, i.e., the alienation of the state – whether despotic, constitutional or republican – marked with its stamp the capitalistic era….

“[T]he national debt has given rise to joint-stock companies, to dealings in negotiable effects of all kinds, and to agiotage [currency speculation], in a word to stock-exchange gambling and the modern bankocracy.

“As the national debt finds its support in the public revenue, which must cover the yearly payments for interest, &c., the modern system of taxation was the necessary complement of the system of national loans. The loans enable the government to meet extraordinary expenses, without the tax-payers feeling it immediately, but they necessitate, as a consequence, increased taxes…. Overtaxation is not an incident, but rather a principle. In Holland, therefore, where this system was first inaugurated, the great patriot, DeWitt, has … extolled it as the best system for making the wage labourer submissive, frugal, industrious, and overburdened with labour.”

–Karl Marx, Capital, Vol. 1, Chapter 31

Whether for purposes of primitive accumulation in the late Middle Ages, expanding the U.S. empire in the Caribbean and Central America at the dawn of the 20th century (taking over Haiti, Dominican Republic, Nicaragua, Honduras, etc., for failure to pay bank debts), or to escape the consequences of financial crisis in the 21st century while ripping up labor gains and turning the remnants of the “welfare state” into platforms for generating private profit, the aim of the capitalists is to relentlessly expand the public debt, not reduce it, as another means of enriching themselves while enslaving workers and whole nations.

All the austerity measures won’t do bupkis to lower the amounts owed by heavily indebted eurozone countries. It is so obvious – not only to leftists and most academic economists but also to rational capitalists – that default in some form (call it “restructuring,” “rescheduling,” “rollover” or whatever) is inevitable that the markets are already pricing this in as they figure the interest on Greek loans (now running at 30% on two-year notes). But if “rescuing Greece” with more loans only “kicks the can” down the road, what then is the point of the “bailouts”? It’s not the size of the Greek public debt (€300+ billion or roughly US$500 billion) that has the bankers worried, nor even the amounts held by European banks (€121 billion, or US$177 billion). It’s not even the “contagion effect” that a Greek default would force similar action by Portugal and Ireland. As financial journalist John Lanchester notes, with only a little exaggeration, “The ECB/EU/IMF ‘troika’ can write a cheque and buy the Greek economy, or the Irish economy or the Portuguese economy” (“Once Greece Goes…,” London Review of Books, 14 July).

Rather, the great fear is that the falling dominoes would soon topple Spain (€774 billion in debt held by European banks, plus €179 billion by U.S. banks) and then Italy (€999 billion held by European banks and €269 billion by U.S. banks). As one European analyst put it, “If Italy goes, it’s no longer a domino. It’s a brick” (New York Times, 12 July). In addition, while U.S. banks hold little Greek debt directly, it is suspected that Wall Street is in hock to the tune of US$100 billion in the form of “credit default swaps” (CDSs) insuring European banks should Athens default. Former U.S. Federal Reserve chief Alan Greenspan noted that Wall Street has “huge liabilities” in European banks, including in supposedly secure money market funds, so many banks would be “up against the wall” in case of a Greek default. Capitalist rulers are terrified at the prospect of a collapse of the euro and ensuing global financial meltdown far surpassing the fallout from the 2008 Lehman Brothers bankruptcy. They’re playing for time for banks to unload unpayable Greek debt so that when the inevitable default comes, someone else (taxpayers, the Greek government) other than Western bankers will be left holding the bag.

So the European and U.S. imperialists want to sacrifice Greek workers and much of the dwindling middle class in order to save the world capitalist financial order. But, some have asked, why would a “socialist” party like that in office in Athens, impose such a fate on its working-class supporters? As mentioned above, PASOK is not a workers party at all, but a bourgeois-nationalist party catering to Greek capitalist sectors who historically have seen the need for a large state sector because of their own small size. And along with the Greek tanker and freighter fleet, Greece’s banks are key to its status as a second-rate imperialist power, financially dominating the southern Balkans and with strong positions in the Near East (Beirut, Cairo). Papandreou will sacrifice Greek workers to prevent that key sector of Greek capital from going down the drain.

What Is To Be Done?

Some heterodox bourgeois economic writers have called for Greece to simply refuse to pay the debt – i.e., to default and leave the eurozone. Economist Michael Hudson suggests to the multitude congregating in front of the Greek parliament:

“The most effective tactic is to demand a national referendum on whether to accept the ECB’s terms for austerity, tax increases, public spending cutbacks and selloffs. This is how Iceland’s President stopped his country’s Social Democratic leadership from committing the economy to ruinous (and legally unnecessary) payments….

“The crowd’s leaders can insist that in the absence of a referendum, they intend to elect a political slate committed to outright debt annulment.”

–“Whither Greece?” Counterpunch (24 June)

A senior editor at the top U.S. financial TV channel, John Carney, harked back to “The Ancient and Noble Greek Tradition of Debt Repudiation” (CNBC, 3 June). Carney was referring to laws of Solon, “the founder of Greek democracy,” who upon coming to power in 594 BCE abolished all debts (called seisachtheia, or shaking off of burdens), as well as banning debt slavery. Carney doesn’t mention that “Greek democracy” was based on a slave society: while ending exclusive rule by the aristocracy (eupatridae), Solon’s reforms only provided for government by the wealthy, not including small peasant owners and sharecroppers (thetes); nor that the poor turned against him when he refused to divide the land – just as the abolition of slavery in the United States and Brazil failed to provide land for the former slaves.

Hudson likewise looks back to Greek antiquity, remarking that “Sparta’s kings Agis and Cleomenes urged a debt cancellation” in the late 3rd century BCE. What Hudson leaves out is that when Agis abolished debts and tried to redistribute land in 244 BCE, he was murdered by resentful landowners; and when Cleomenes tried again in 227, the landed interests brought in the Macedonians to defeat this attack on their power, forcing the Spartan king into exile and stopping his reforms. To be sure, Greek working people today cannot defeat the assault on their livelihoods and their lives without repudiating the debt to the imperialist banks. But this will not be accomplished by simply holding an election or voting it down in a referendum. The capitalist bloodsuckers who profit from this modern debt slavery won’t be swayed by democratic niceties. They would certainly call in military force to stop this attack on their interests, as Macedonians did over two millennia ago. Or as the Greek generals did in 1967 to prevent an election victory by the current Papandreou’s grandfather Georgios and his father Andreas. Only this time, George Jr. seems prepared to call in the military himself in defense of Greek and European capital.

Some petty-bourgeois sectors, including left nationalists such as the Greek Communist Party (KKE), are in favor of simply refusing to pay the accumulated mountain of debt and leaving the eurozone. Speaking at a rally during the June 15 strike called by the PAME labor federation, KKE general secretary Aleka Papariga declared, “the slogan that is relevant and mature today is: rupture, overthrow, disengagement from the EU.” A leader of PAME, Alekos Arvanitidis, added: “We do not recognise any debt…. We do not to accept that we should pay a single cent, not one euro. The plutocracy must pay. Now, we must struggle for disengagement from the EU.” Those calling for Greece to leave the European Union and replace the euro with the drachma point to the experience of Argentina, which in January 2002 defaulted on its unpayable debt. The fact that it has ever since been frozen out of international financial markets has not stopped the South American country’s economy from growing. But the immediate result of this step by the bourgeois politicians under pressure from the street was years of mass unemployment of Argentine workers. The same would be true in Greece today.

How do the advocates of a Greek default and exit from the euro plan to get there? PAME leader Arvantidis asked: “So, what kind of movement do we need? A peaceful movement, a movement of silent protest, a movement of which simply makes contemptuous hand gestures?” (In Madrid’s Puerta del Sol, when demonstrators waved both hands in the air it was a kind of silent applause. In Greece, the symbol of protest in Syntagma Square, holding up all five fingers of an outstretched hand, the moutza, is a traditional insult or curse.) His answer was “a movement that will be a thorn in the sides of the plutocracy.” Actually, what’s required is to overthrow all the capitalists, with workers revolution. But that’s not what the Greek Stalinist-reformists have in mind. Their real aim was highlighted the next day in demonstrations calling for “a powerful KKE in the struggles and elections.” Like others on the reformist and popular-frontist left, including the SYRIZA and ANTARSYA coalitions, the KKE is calling for new elections to vote out PASOK. What will likely result is a return of the rightist New Democracy, but even if there was a strong left showing, it at best would produce another “left” bourgeois regime.

The several ostensibly Trotskyist groups in Greece basically are all calling for a general strike. Last year (see our article, “Greece on the Razor’s Edge,” The Internationalist No. 32, January-February 2011), when the Greek unions were calling a one-day “general strike” just about every month, some leftists, such as Marxistiki Foni, supporters of the International Marxist Tendency (IMT) of Alan Woods, called for a two-day general strike. So now that Greece has had its first two day general strike in years, what next? “What is required is that the struggle be escalated into an extended political general strike” (“Greece: A Critical Moment in the Struggle,” In Defense of Marxism web site, 30 June). But even in calling for an open-ended general strike, the pseudo-Trotskyists do not call for real preparations for a struggle for power. What about the need to form workers defense guards? Or calls to fraternize with the army, to win over the ranks to the side of the workers? They don’t even call to forge a revolutionary vanguard party, saying only that a “mass revolutionary tendency will emerge within the workers’ organisations.” In fact, they are not preparing for revolution at all, but raising one pressure tactic after another.

The pseudo-socialists ignore the fact that the current war on workers is not a policy (“neo-liberalism”) which could be changed, but a necessity for a decaying capitalist system. Keynesian policies were abandoned in the late 1970s because of a severe crisis caused by a falling rate of profit. While the current profit rates are obscene, schemes like “tax the rich” or taxes on stock market transactions (the Tobin tax) will not make it profitable for capital to invest in productive capacity, as it has failed to do on a substantial scale in the advanced capitalist countries since the early 1980s. Instead, bankers furiously refuse to take a “haircut” (loss) on Greek loans, however packaged. Their response is not irrational: they know, if the reformist left does not, that the entire international capitalist financial system is technically (and actually) bankrupt and could come crashing down on the least hiccup. Companies refuse to invest, refuse to hire and instead sit on vast piles of cash, while executives cash out by paying themselves fabulous sums for accomplishing nothing. Their attitude, like that of Louis XV and the Old Regime prior to the French Revolution, is après moi le déluge (after me comes the flood) – and they act accordingly.

The

only way to lift the crushing burden of

debt that

is keeping Greek working people in thrall is

socialist revolution, not

just in

Greece but throughout Europe and the world. ■

[1] According to statistics of the Organization of Economic Cooperation and Development (OECD), Greeks actually work 52 percent longer than Germans (2,119 hours a year compared to 1,390), and receive less than half as much in pensions, averaging under €1,000 a month (“A Tale of Two Europes,” Kathimerini [Athens], 6 July).

To contact the Internationalist Group and the League for the Fourth International, send e-mail to: internationalistgroup@msn.com