June 2021

Expropriate

the Ruling Class Through Socialist Revolution!

“Tax the Rich” No Answer to Capitalist

Inequality

“Tax the Rich” protest outside Washington, D.C. mansion of Amazon owner Jeff Bezos, May 2021.

(Photo: Jonathan Ernst / Reuters)

Inequality in the U.S. – which has long been acute – reached staggering proportions as a result of the economic crisis set off the by the coronavirus pandemic. Low-paid essential workers were made to bear the brunt of the deadly plague at the front lines with little protection from the virus. Millions forced out of work had to rely on financial assistance, many facing the threat of eviction. Meanwhile, the wealthiest capitalists made out like bandits. Since the beginning of the pandemic in March 2020, as the workers’ income from wages fell, some 660 U.S. billionaires received a windfall of $1.1 trillion (that’s 12 zeros). Of this, $300 billion went to five modern-day robber barons: Jeff Bezos, Elon Musk, Bill Gates, Mark Zuckerberg and Warren Buffett.1

Now a report by the non-profit investigative journalism organization ProPublica has come out revealing that the same five, plus the other 20 richest Americans, paid a minuscule amount in federal income taxes on their growing wealth., How much? A mere 3.4% on their collective haul of $401 billion in increased net worth from 2014 to 2018.2 Some, including Bezos, Musk, Michael Bloomberg and George Soros, managed to pay no federal income tax at all in some years. Buffett, the hands-down champion in tax avoidance, paid 0.1% (that’s one-tenth of one percent) on his earnings of almost $24 billion in that period. The median taxpayer in the U.S., in contrast, paid an average of 14% in federal income taxes.

Modern-day capitalist robber barons

Jeff Bezos, Michael Bloomberg and Elon Musk all managed to pay

zero federal income taxes. (Photos:

from left, Joshua Roberts /Reuters; Logan Cyrus /

Agence France-Presse; Mike Blake / Reuters)

Modern-day capitalist robber barons

Jeff Bezos, Michael Bloomberg and Elon Musk all managed to pay

zero federal income taxes. (Photos:

from left, Joshua Roberts /Reuters; Logan Cyrus /

Agence France-Presse; Mike Blake / Reuters)While the titans of U.S. capitalism were raking in their pandemic winnings, the Institute for Policy Study and Americans for Tax Fairness, two liberal think tanks which calculated these figures, noted that that over 73 million U.S. workers lost their jobs after late March 2020, with 16 million still unemployed at year’s end; 12 million lost employer-sponsored healthcare; 29 million adults reported not having enough food in December, while 14 million were behind on their rent. The glaring spectacle of the ruling class gouging megaprofits from disease and death, and being rewarded for doing so with free money in bailouts and tax cuts from the CARES Act, has led to a resurgence of calls to “tax the rich.”

This slogan has become the calling card of the Democratic Socialists of America (DSA) and groups that tail after and adapt to it (Socialist Alternative, Left Voice, Freedom Socialist Party, Party for Socialism and Liberation and others). In New York City, the DSA had a whole “tool kit” with an elaborate infographic at https://taxtherichnys.com/. It put forward a series of legislative proposals to raise state taxes on family incomes above $450,000 a year, a capital gains tax, an inheritance tax, a wealth tax, a financial transactions tax and “fair corporate taxes.” The same tax proposals are raised by the “Invest in Our New York” campaign, a coalition including New York Communities for Change, Make the Road, Alliance for Quality Education and other NGOs (non-governmental organizations), the Working Families Party (WFP) and NYC-DSA.

This is the Democratic Party-NGO complex,3 plus the WFP, a long-time satellite which gives Democratic candidates another ballot line to run on, and the DSA, whose candidates run as Democrats and which is functionally part of this capitalist party. (There are currently six DSA Democrat NY state legislators.) The stated aim of the package of a dozen bills in the New York legislature, said the NYC-DSA, was to ensure “that rich New Yorkers are taxed their fair share.” Other proposals, including a fund to provide aid to workers, mainly immigrants, excluded from federal pandemic programs also called for financing by a “billionaires tax,” which DSA Democrat star Alexandria Ocasio-Cortez (“AOC”) endorsed in a viral video last summer.

Now Democratic president Joe Biden weighed in with his $6 trillion budget for fiscal year 2022, to be paid for with a “$3.6 Trillion Tax Increase on the Rich and Companies” (New York Times, 29 May). The aim, says his budget document, is to “ensure that large corporations are paying their fair share” and that “high-income Americans pay the tax they owe.” Even Bill Gates and Warren Buffett have called for raising income taxes on the rich. It seems that everyone from Biden and the billionaires themselves to Democratic “progressives” like Bernie Sanders, the Democratic (Party) Socialists of America, and its opportunist left tails are agreed that the rich need to pay their “fair share.” But what exactly does that mean?

DSA supporters in New York City

distribute door hangers calling to pressure Democratic state

legislators to “tax the rich,” February 2021. (Photo: NYC DSA)

DSA supporters in New York City

distribute door hangers calling to pressure Democratic state

legislators to “tax the rich,” February 2021. (Photo: NYC DSA)The idea that capitalism can be made “fair,” a staple of bourgeois ideology, was unmasked by Karl Marx a century and a half ago. For pseudo-socialists and labor reformists, the appeal to “tax the rich” is yet another means to subordinate the working class to the Democratic Party, calling on people to pressure their “elected representatives.” It is similar in this way to the calls last summer to “defund the police,” which as we said then sought to divert mass protests in the streets against racist cop murder into lobbying city councils over budget allocations. In this case, the NYC-DSA “blanketed key lawmakers’ districts with door hangers” urging people to tell their legislator to “tax the rich.”4 Revolutionary Marxists, in contrast, are not in the business of advising the capitalist state on how to “fairly” finance its apparatus of war and repression, but call to expropriate the capitalist exploiters.

For capitalist politicians, “tax the rich” rhetoric is a way to hoodwink working people into thinking that something is being done about the obscene capitalist inequality that has escalated for decades as workers’ wages stagnate, and then skyrocketed during the pandemic as the Internet moguls reaped superprofits. Biden, who had more backing from billionaires than Trump, ran his presidential campaign in part off disgruntlement with Trump’s tax cuts. Yet his budget proposal preserves much of Trump’s cuts. Under the Biden budget, only capitalists in the very top bracket will face a pre-Trump marginal rate, an increase of a mere 2.6 per cent, while the corporate income rate will go up just 7 per cent, still lower than before Trump took office. Still, AOC opined that Biden “definitely exceeded expectations that progressives had.”

As for the Biden administration’s plan to almost double the capital gains tax,5 from 20% to 39.6%: “Wealthy Americans will avoid paying 90% of the estimated $1 trillion increase in investment taxes that President Joe Biden is proposing this week, according to new study from the University of Pennsylvania's Wharton Business School. The Wharton researchers concluded that tax avoidance, much of it legal, would cut nearly $900 billion of what the proposed increase on capital gains taxes could raise for the government.”6

Democrat-WFP-DSA “tax

the rich” campaign declares victory in New York state budget,

April 2021. (Photo: Invest in

Our New York)

Democrat-WFP-DSA “tax

the rich” campaign declares victory in New York state budget,

April 2021. (Photo: Invest in

Our New York)Calls to “tax the rich” are just tinkering, and won’t affect the fundamentals of a system that produces fabulous wealth for the owners of capital and grinding poverty for millions, while the working class lives paycheck to paycheck. In New York, a few tax hikes on the wealthy were actually passed in April. “Invest in Our New York” cheered, “We won!” But while their raft of tax bills was supposed to raise from $48 billion to $70 billion in new revenue, what they “won” was only $4.5 billion in increased top-tier and corporation income taxes. The additional tax bite for a couple making $2.5 million a year would be about $21,000, “roughly equal to the cost of a used Chevy Malibu,” as columnist Ginia Bellafante noted in the New York Times (11 April).

These calls also blur over the obvious fact that the government already has at its disposal more than enough funds to meet dire human needs. Such demands are of a piece with reformist calls for “money for jobs/books/education, etc., not for war/bombs/occupation.” They are phrased in terms of budgetary priorities, when the issue is class interests. As liberals push the lie that the capitalist state just doesn’t have enough money, proposals to fill supposed budgetary shortfalls are painstakingly debated and scrutinized, even as enormous subsidies are handed over to the rich without batting an eye. Under the $2 trillion CARES Act, $500 billion in free money was earmarked specifically for large corporations, with no strings attached.7

Democratic president Joe Biden

wants to “tax the rich” in order to prepare for war on China.

(Photo: Reuters)

Democratic president Joe Biden

wants to “tax the rich” in order to prepare for war on China.

(Photo: Reuters)The real question to pose is, who does the state power serve? And the answer is: tax hike or no, whether conservatives or “progressives” are in office, this state defends capitalism against the working people. The Democratic politicians who last year imposed racist curfews and dispatched militarized police forces to assault anti-racist protestors are hardline defenders of U.S. imperialism. Biden’s budget says that its aim is to “position the United States to out-compete China,” to “counter the threat from China” and “the growing ambitions of China,” etc. – in other words, to rev up U.S. imperialism’s anti-China war drive. As for military outlays ($753 billion, up from $740 billion under Trump), the Times (29 May) summed it up: “The Pentagon pivots to a possible war with China.” This is an anti-China war budget.

Revolutionary Marxists’ critique of liberal tax gimmickry obviously does not mean opposing raising taxes on the capitalist class, or measures in the interest of working people, such as to increase funding for schools or to provide emergency aid to excluded workers, that are linked to increased taxes on the wealthy. But the “tax the rich” campaigns mean voting for budgets of the capitalist state, the enforcer of oppression. Together with talk of “our tax dollars,” they spread illusions that the capitalist state is somehow accountable to “the people.” The American ruling class never was and never will be beholden to working people. Our aim is not to exact a pittance from the wealthy, but to expropriate the capitalist class so that the exploited and oppressed can take their destiny into their own hands. In a word, revolution.

How Much the Ruling Class Really Pays

“Tax the rich?” Under Republican president

Dwight Eisenhower, top federal income tax rate was 91% in

1951. Under “Green New Deal” of red-white-and-blue Democratic

“progressive” Alexandria Ocasio-Cortez, top rate would only be

70%. (Photo: White House; CNN)

“Tax the rich?” Under Republican president

Dwight Eisenhower, top federal income tax rate was 91% in

1951. Under “Green New Deal” of red-white-and-blue Democratic

“progressive” Alexandria Ocasio-Cortez, top rate would only be

70%. (Photo: White House; CNN)Calls to “tax the rich” can in fact mean just about anything. Promises of higher taxes on the wealthy and increased social services are easy crowd pleasers on the campaign trail for Democrats. And they don’t have to worry about following through: whatever gets passed in the House, they can blame Republicans and “moderate” Democrats in the Senate for it not getting enacted. While many would-be leftists were skeptical about Biden, even after they called to put him in office, there is a lot of misplaced hope in “progressive” Democrats, from Alexandria Ocasio-Cortez to Elizabeth Warren. AOC’s proposal to increase the top marginal tax rate sounds hefty, but even Bloomberg News (7 January 2019) pointed out, “Ocasio-Cortez’s 70% Tax Idea Isn’t Very Radical,” and that “it won’t do much to… raise revenue or lower inequality.”

A glimpse at history shows this. The U.S. maintained top marginal income tax rates of 70% or more for decades, from the Democratic Franklin Delano Roosevelt (FDR) administration in the 1930s and ’40s up until Ronald Reagan took office in 1981, peaking at 94% in 1944-45. Under Republican Dwight D. Eisenhower in the early 1950s, the top rate was 91%. Far from serving to reduce inequality, the purpose of this tax policy was, first of all, to fund the imperialist World War II, from which the United States emerged as the dominant world power. Tax rates remained high through the Cold War as U.S. imperialism sought to spur counterrevolution in the bureaucratically degenerated or deformed workers states of the Soviet bloc and China, including waging hot wars in Vietnam and Korea, and building up an enormous (and enormously expensive) nuclear arsenal.

Although taxes then were higher than they are today, the ruling class never actually paid a rate anywhere near 70-90 per cent. Accounting for all taxes on individual incomes, payroll, estates, corporate profits, properties and sales on the federal, state and local levels, the effective tax rate on the “top 1%” peaked during the 1940s and ’50s at between 40% and 45% of pre-tax income. By 2018, with the top income tax bracket at 39%, the effective tax rate on the richest 400 families was down to 23%, lower than the rate on the bottom half of U.S. families. For the bourgeoisie, tax avoidance has become a science, what with the much lower capital gains rate (now 20%); use of “stock options” (taxed as capital gains) for executive pay; tax-deductible “business expenses”; tax dodges like “carried interest,” and myriad other “loopholes.”

Add to that additional deductions for donations, including those that go to think tanks and bourgeois propaganda “foundations,” for owning private jets (as a business expense), yachts (chartered as a separate business), even pools (for proven “medical purposes,” of course). For the last several years Tesla CEO Elon Musk’s salary has been equivalent to the California minimum wage – and he boasts that he’s never even cashed the checks. “In 2018, Tesla founder Elon Musk, the second-richest person in the world, also paid no federal income taxes,” reported ProPublica (8 June). Yet in 2018 his company gave him $2.3 billion in stock options, “one of the ten largest pay packages of all time” (New York Times, 13 June). And then there is Donald Trump, who got away with paying only $750 in federal income tax in 2016 and 2017.

Meanwhile, the tax rate on the income of corporations is also deliberately much lower than that on individual income, and myriad deductions lower it even further. Take Amazon, which last year paid a federal corporate tax for the first time since 2016, shelling out a mere 1.2 per cent of pre-tax earnings while the statutory rate was 21 per cent. In 2018, after making $79 billion in profits Amazon paid nothing, and received $4.3 billion in rebates from the state. So, yes, wealthy individuals and giant corporations get away with paying very little in taxes, while working people are left holding the bag. But what the “tax the rich” Democrats are calling for would hardly change that.

Elizabeth Warren, now on the Senate Finance Committee, is pushing her “wealth tax.” This would consist of a paltry two cents on the dollar for fortunes greater than $50 million. AOC’s 70% top marginal income tax rate would only be on incomes over $10 million. The cut-offs on these tax plans would let plenty of very rich people off the hook. As we have pointed out about the Occupy Wall Street slogans of “the top 1%” against “the 99%,” often invoked by Bernie Sanders, these give vent to the frustrations of those facing economic hardship under decaying capitalism without challenging the property relations that breed this inequality. What, for example, about the members of the ruling class in the second percentile? And what about the racist cops doing their dirty work, whose incomes put them in the “99%” but who are enemies of the working class?

Fiddling with tax rates is not by any means radical. Increasing taxes on the rich is neither incompatible with the capitalist system in general, nor with the free-market “neoliberalism” that the reformist left lambasts. Some defenders of capitalism support raising taxes on certain sectors of the ruling class in order to promote productive investment rather than financial speculation. So while DSAers hailed Elizabeth Warren as a “foe of Wall Street”8 – even as this former Republican described herself as “capitalist to the bone” – during the Democratic presidential primaries, The Economist (22 June 2019), hailed Warren as the “saviour of capitalism.” This mouthpiece of London financiers quoted Fox News host Tucker Carlson’s remarks that Warren’s policies to revive industry are “like Donald Trump as his best.”9

Expropriate the Capitalist Class with Workers Revolution

“Tax the rich” proponents argue that raising rates on the wealthy would generate revenue to fund social benefits and services for the working class. Again, the issue is not of insufficient funds. Enormous subsidies are handed over to capitalists, and vast expenditures are needed to fund U.S. imperialism’s war machine and domestic repression. The state, which is what taxes go to finance, isn’t some tool that can be taken hold of by anyone, it is the apparatus by which the ruling class defends and upholds its rule, keeping the machinery of exploitation running by squeezing profits out of the labor of the working class. The tax code expresses the budgetary needs of the state; any allocation of revenue towards social programs is part of and subordinate to that goal.

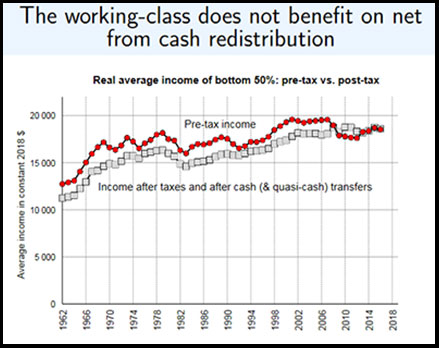

In appendix to their book,

The Triumph of Injustice: How the Rich Dodge Their Taxes and

How to Make them Pay, Emmanuel Saez and Gabriel Zucman

show that working class does not benefit from cash transfers

through taxes. (Photo: W.W.

Norton Co.)

In appendix to their book,

The Triumph of Injustice: How the Rich Dodge Their Taxes and

How to Make them Pay, Emmanuel Saez and Gabriel Zucman

show that working class does not benefit from cash transfers

through taxes. (Photo: W.W.

Norton Co.)To the degree that they serve to defuse protest, such social measures may contribute to prolonging the life of the capitalist system. Neither they nor the tax system fundamentally change the position of the working class in respect to the ruling class. In an online appendix to their book The Triumph of Injustice: How the Rich Dodge Their Taxes and How to Make Them Pay, Emmanuel Saez and Gabriel Zucman (who are advocates of Elizabeth Warren’s wealth tax) show that from 1962 to 2018 working-class incomes were consistently lower after factoring in both taxes and cash transfers from the government, concluding: “the working-class does not benefit on net from cash distribution.”10 Using different metrics, Marxist economist Anwar Shaikh calculates the ratio of social benefits to taxes paid by U.S. workers from 1952 to 1993, finding that the working class as a whole received less than it paid for, in effect subsidizing the ruling class via taxes as well as through its labor.11

The 1950s,’60s and early ’70s were marked by grotesque episodes of racist repression, while poverty was rampant in the South, Appalachia and the Northern ghettos, yet the working class received a significantly higher share of national income than it does today. The core reason is not taxes, but the strength of the labor movement. Private sector unionization peaked at 35 per cent in the 1950s compared to 6.3 per cent in 2020.12 From the 1970s onward, seeking to offset capitalism’s falling rate of profit, the ruling class went on the offensive, outsourcing much of U.S. industry and busting unions. That offensive, and the lack of large-scale and militant working-class resistance due to the pro-capitalist labor bureaucracy that chains the unions to the Democratic Party, are key to the growing inequality we have witnessed over the past several decades.

“Tax-the-rich” reformist leftists

divert social struggles into pressuring the Democrats. Right:

Instagram tile for rally on Democrat Joe Biden's Inauguration

Day, 20 January 2021, calls to “fight the far right.” (Photo: Socialist Alternative /

Instagram)

“Tax-the-rich” reformist leftists

divert social struggles into pressuring the Democrats. Right:

Instagram tile for rally on Democrat Joe Biden's Inauguration

Day, 20 January 2021, calls to “fight the far right.” (Photo: Socialist Alternative /

Instagram)Calls to “tax the rich” perpetuate this pattern, by spreading illusions and helping divert the struggles of workers and the oppressed into pressuring the Democrats. Under both Bill Clinton (1993-2000) and Barack Obama (2009-2016), Democratic administrations continued the same anti-worker economic policies as Republicans Bush I and II. Meanwhile, they blocked workers’ struggles with anti-labor laws such as the Taft-Hartley Act, administered by the National Labor Relations Board (NLRB), set up by FDR under the 1935 Wagner Act to bring unions under the thumb of the capitalist state. Today, the response of the AFL-CIO tops to the defeat of the union organizing drive at Amazon in Bessemer, Alabama, has been to lobby for the Democrats’ PRO (Protecting the Right to Organize) Act bill – i.e., appealing to the capitalist state.

Reformist union reform groups in New York City

held a “tax the rich teach-in” to build support for

“progressive” Democrats’ Invest in Our New York campaign,

March 2021. (Photo: Local 100

Fightback Coalition / Facebook)

Reformist union reform groups in New York City

held a “tax the rich teach-in” to build support for

“progressive” Democrats’ Invest in Our New York campaign,

March 2021. (Photo: Local 100

Fightback Coalition / Facebook)It’s not just the labor fakers sitting atop the unions who peddle this fool’s gold. In March, various union reform groups in New York City – including the Movement of Rank and File Educators (M.O.R.E.) in the United Federation of Teachers (UFT), Local 100 Fightback (TWU) and DC 37 Progressives – joined with the NYC-DSA in a “Tax the Rich Teach-In” to promote the bills in Albany put forward by the “progressive” Democrats’ Invest in Our New York campaign. At the same time, M.O.R.E. issued yet another statement against “being forced back into school” while lamenting that “the ultra-wealthy continue to fight as hard as they can against paying their fair share in taxes.” In the UFT Delegate Assembly, it put forward a “Resolution on Tax the Rich, Invest in Our NY.”

Rather than looking to the

capitalist Democratic Party, Class Struggle Education

Workers called on unions to use their power to reopen schools

safely. Rally for safe schools by Brooklyn, NY UFT

chapters, October 2020. (Photo:

CSEW)

Rather than looking to the

capitalist Democratic Party, Class Struggle Education

Workers called on unions to use their power to reopen schools

safely. Rally for safe schools by Brooklyn, NY UFT

chapters, October 2020. (Photo:

CSEW)While the self-proclaimed “social justice unionists” of M.O.R.E. were phone-banking to get teachers “not to go in to work” and to support the Democrats’ “tax-the-rich” bills, Class Struggle Education Workers (CSEW) called instead to “Use Union Power to Reopen Schools Safely,” calling “For Union-Led Teacher-Student-Parent-Worker Control of the Schools” and denouncing the “bipartisan capitalist war on public education.”13 (The CSEW is a union tendency which works fraternally with the Internationalist Group.) On Amazon, the IG calls to unionize the internet retail giant with hard class struggle, while warning against illusions in the Democrats and the PRO Act, which will continue the subordination of the unions to the NLRB.

At bottom, this is a question of class. Calls to “tax the rich” take responsibility for financing the machinery of the capitalist state, the instrument by which the bourgeois rulers regiment working people and the oppressed. We demand that undocumented immigrant workers get the desperately needed unemployment benefits they have been denied throughout the duration of the COVID pandemic, and billions of dollars go to safely reopening public schools. But we don’t act as advisors to the capitalists and their politicians saying where this money should come from. That’s their problem. And the only way to win these and other crucial demands is through hard class battles, not by leaving doorhangers or voicemails for your local congressperson and state senator.

Some disingenuous opportunist leftists try to justify the “tax the rich” slogan by citing the call of Karl Marx and Friedrich Engels in the Communist Manifesto (1848) for “a heavy progressive or graduated income tax.” That demand, raised on the eve of the 1848 revolution, corresponded to a historical period when in much of Europe, including Germany, a bourgeois revolution against feudalism and its remnants in the absolutist monarchies was posed. Marx and Engels proposed a program of immediate tasks, “a first step in the revolution,” to “win the battle of democracy,” consisting of demands that were compatible with a bourgeois revolution but pointed in the direction of attacking the rights of property. Their ten-point program also included “Free education for all children in public schools,” a simple democratic demand, written into many bourgeois constitutions, but which is frequently under attack in capitalist countries.

Yet since the turn of the 20th century, we have been in the era of imperialism, of decaying capitalism. In the U.S., the income tax was graduated, with higher rates for the rich, from its introduction by Woodrow Wilson in 1913. This is almost everywhere the case, for the simple reason that even “soaking the poor” can only raise so much. That doesn’t make a “progressive” income tax “anti-capitalist” – its purpose is to defend the interests of capital, particular in war. Wilson introduced it to finance World War I and Roosevelt greatly expanded it in WWII. As for the rich paying “their fair share,” there is no “fairness” under capitalism. The profit system can’t satisfy human needs, as was shown by the horrendous death toll of the COVID pandemic, with the failure to stop the spread of the deadly virus, the underproduction of medical supplies, etc.

Revolutionary Marxists – Trotskyists – insist that the capitalist ruling class can’t be taxed into providing for social needs, it must be expropriated once and for all. To do that requires an unrelenting fight for working-class political independence from the capitalist rulers. As Karl Marx put it in 1871, “The workers’ party must never be the tagtail of any bourgeois party; it must be independent and have its goals and its own policy.” The Internationalist Group calls to break with the Democrats, Republicans, and all bourgeois parties to form a revolutionary workers party that can lead the struggle to expropriate capitalism through socialist revolution.

“Fairness”? As Marx wrote in response to the slogans of the reformists of his day:

“Instead of the conservative motto: ‘A fair day’s wage for a fair day’s work!’ they ought to inscribe on their banner the revolutionary watchword: ‘Abolition of the wages system!’”

– Karl Marx, Value, Price and Profit (1865) ■

- 1. “U.S. Billionaire Wealth Surpasses $1.1 Trillion Gain Since Mid-March,” Institute for Policy Studies, 26 January.

- 2. “The Secret IRS Files: Trove of Never-Before-Seen Records Reveal How the Wealthiest Avoid Income Tax,” ProPublica, 8 June.

- 3. Several are led by members of the Center for Popular Democracy, successor to the ACORN pro-Democratic Party voter registration group.

- 4. “New York Raises Taxes on the Rich as State Shifts Leftward,” HuffPost, 11 April.

- 5. Capital gains are the profit from selling a capital asset (like stocks and bonds) for more than that its cost.

- 6. “Wealthy would dodge 90% of Biden's capital gains tax increase, study says,” CBS News, 29 April.

- 7. “The U.S. plans to lend $500 billion to large companies. It won’t require them to preserve jobs or limit executive pay,” Washington Post, 28 April 2020.

- 8. Zaid Jilani, “Why the Differences Between Sanders and Warren Matter,” Jacobin website, 8 January 2019.

- 9. “Warren, the saviour of capitalism,” The Economist, 22 June 2019.

- 10. Slide 61, at https://gabriel-zucman.eu/files/SZ2019Slides.pdf.

- 11. Anwar Shaikh, “Who Pays for the ‘Welfare’ in the Welfare State? A Multicountry Study,” Social Research, Vol. 70, No. 2 (Summer 2003).

- 12. Lawrence Mishel, Lynn Rhinehart and Lane Windham, “Explaining the erosion of private-sector unions,” Economic Policy Institute, 18 November, 2020.

- 13. See “Chaotic Reopening of NYC Schools: This Is What Mayoral Control Looks Like,” The Internationalist No. 62, January-March 2021.

“Tax the Rich”?

The Working Class Paid for the New Deal

Auto workers at GM's Fisher Body plant reading newspapers during the 1936-37 sit-down strike. Roosevelt made concessions to unions in order to co-opt a radical labor movement led by “reds.” (Photo: United Press International)

The example cited by liberals and reformist pseudo-socialists who promote tax-the-rich schemes as a means to redistribute wealth and amply fund social services is Franklin Delano Roosevelt’s New Deal. This is the reference point for Ocasio-Cortez’s “Green New Deal” in particular. They would have us believe that the New Deal was a huge wealth redistribution funded by robust progressive taxation on the wealthy. Right-wingers called it “socialism.” Both are far from the truth. The aim of the New Deal was to save the ruling class from the threat of revolution during the worst economic crisis in the history of capitalism, and to rev up “national unity” leading into World War II. Symbolic concessions to labor were needed to co-opt a radical labor movement led by “reds,” including the Stalinist Communist Party in the new mass unions of the Congress of Industrial Organizations and Trotskyist Teamsters in Minneapolis.

At the time, certain sectors of the U.S. bourgeoisie denounced Roosevelt as a “traitor to his class,” but this was either cynicism or an inability to see the big picture. FDR legally recognized the right to organize unions and collectively bargain in order to exert state control over labor, which was exploding with general strikes, sit-down strikes and other militant tactics. Limited state-funded public employment benefitted consumer-goods manufacturers and retailers, and although the owners of heavy industry were not too happy, such measures ultimately served to prolong American capitalism’s survival. The business journalist Ferdinand Lundberg described the meaning of Roosevelt’s policies in his book profiling the U.S. capitalist elite, America’s 60 Families, published during Roosevelt’s second term:

“The ‘New Deal’ is not revolutionary nor radical in any sense; on the contrary it is conservative…. Roosevelt, addicted as he is to verbal castigation of the wealthy, was supported in 1932 and again in 1936 by some of the richest families of the country…. The ‘New Deal,’ in short, has represented one side of a grave split in the camp of the big capitalists … although questions relating to capitalism and its basic theory have not really been in dispute.”

–Ferdinand Lundberg, America’s 60 Families (1937)

FDR was up-front about the aims of his New Deal. As he introduced his Revenue Act of 1935, dubbed by some of its proponents the “Soak the Rich Tax,” he explained: “I am fighting communism…. I want to save our system, the capitalistic system.” The Act raised the statutory rate on the top tax bracket up to 75 per cent, but in reality, in the words of a bourgeois historian, it “neither soaked the rich, penalized bigness, nor significantly helped balance the budget.”1 The New Deal was funded in the first place, not by taxes, but by government debt. The state handed out loans to sectors of big business through the Reconstruction Finance Corporation and sold the debt as bonds to the banks.

A year later, the conservative London Economist applauded Roosevelt’s efforts to shield the ruling class, calling the New Deal “a great success.”2 Although it helped the bourgeoisie stave off the threat of workers revolution, it failed to stimulate economic growth while continuing to balloon debt. It was not until World War II that U.S. imperialism began to reemerge from the Depression, through the direct intervention of the state in channeling investment and by the destruction of the productive power of competing capitalist powers, later to be rebuilt on U.S. credit. As far as taxation is concerned, the New Deal was not progressive, but deeply regressive. FDR’s wealth taxes were purely cosmetic, openly flouted by the capitalists, and contributed little in revenue.

The New Deal was actually financed in large part by excise taxes, hidden taxes on particular manufactured goods that targeted working-class consumption, already suppressed as a result of the Depression. They even taxed matches, playing cards, movie tickets, candy, chewing gum, phone calls, radios and electricity. These excise taxes which hit working people hardest contributed far more revenue during the New Deal than did income taxes on the wealthy. In all:

“[S]ocial insurance and indirect taxes (tariffs; the excise taxes on liquor, tobacco, and selected manufactured items; and the agricultural processing taxes) became the largest share of revenue, jumping from 33 percent in the supposedly business oriented New Era [under the previous Hoover administration] to 47-65 percent in the Forgotten Man’s New Deal.”3

FDR’s legacy with regards to taxation was not “taxing the rich,” but taxing the poor … and slapping federal income taxes on the working class. Roosevelt was responsible for the expansion of federal income tax from a “class tax,” exclusively levied on the wealthy, to a “mass tax” imposed on the majority of working class. Only then did income taxes finally exceed the contribution of excise taxes to government revenue.

During the ’30s no more than 5% of the population paid federal income tax. To fund U.S. involvement in the Second World War, the Roosevelt administration aggressively pushed to expand the tax base, principally with the Revenue Act of 1942, which also charged an additional Victory Tax and reduced exemptions. Payroll tax withholding was introduced the following year, and excise taxes were further increased. At the same time as prices rose, wages were frozen by FDR and a “no-strike pledge” was forced on workers by the government through the union bureaucracy. Between 1940 and 1945 the number of federal taxpayers sextupled, with about 90% of U.S. workers filing income tax forms and 60% paying taxes on their incomes4

As the U.S. was gearing up to join in the imperialist slaughter of World War II, from which it would emerge with the victor’s spoils, George Novack of the Socialist Workers Party (at that time the voice of authentic Trotskyism) wrote an epitaph for the New Deal:

“Roosevelt rode into office thundering against ‘the economic royalists’ on the home front. In 1932 he threatened ‘to drive the money-changers out of the temple.’... Now, in 1940 we hear equally martial music from the White House but on a different theme. The struggle against ‘the malefactors of great wealth’ at home has been set aside for the struggle against ‘foreign aggressors.’… The New Deal has been replaced by the War Deal…. [It] was the price American capitalists had to pay for insurance against social revolution…. Roosevelt’s war policy shows how, under the capitalist regime, the aims, and interests of Big Business force themselves through against all obstacles, until they become the official governmental program, even of erstwhile opponents.”

– George Novack, “Autopsy of the New Deal,” Fourth International, May 1940. ■

- 1. Paul Conkin, The New Deal (Crowell, 1975).

- 2. “The New Deal,” The Economist, 3 October 1936.

- 3. Mark H. Leff, The Limits of Symbolic Reform: The New Deal and Taxation, 1933-1939 (Cambridge University Press, 1984).

- 4. Carolyne C. Jones, “Class Tax to Mass Tax: The Role of Propaganda In The Expansion of the Income Tax During World War II,” Buffalo Law Review 37, No. 3 (1988); IRS, “The Wealth Tax of 1935 and the Victory Tax of 1942” (https://apps.irs.gov/app/understandingTaxes/teacher/whys_thm02_les05.jsp).